CANNABIS BANKING GUIDE | MINNESOTA

Build a Compliant Cannabis Banking Program in Minnesota

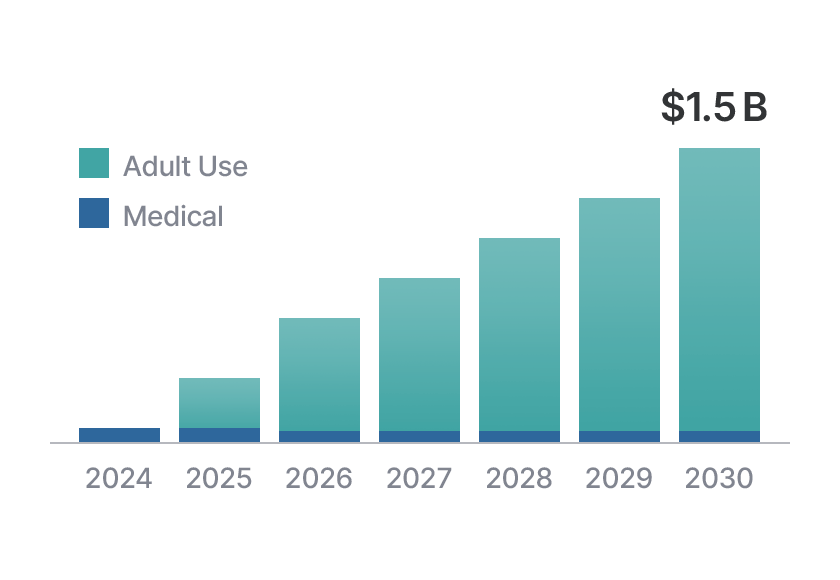

Minnesota’s cannabis industry is taking off. With adult-use sales launching in September 2025, New Frontier Data projects the market will skyrocket from $90 million in 2024 to $1.5 billion by 2030. Shield’s Cannabis Banking Playbook offers a roadmap for financial institutions to serve cannabis-related businesses compliantly, efficiently, and profitably.

What every Minnesota banker should know about cannabis banking.

Cannabis banking brings significant growth potential, along with challenging operational demands and complex regulations. Get started by defining your path forward.

-

Build a business case for cannabis banking.

-

Understand the risks.

-

Develop strategies to mitigate risk.

-

Implement systems to promote compliance and client service.

NEED TO KNOW

Projected Market Growth in Minnesota

Source: New Frontier Data

Boost your balance sheet with cannabis banking in the North Star State.

Given the complexities of this line of business, financial institutions must understand the economics of cannabis banking and tailor their products and services to meet the evolving needs of their customers. By establishing policies and procedures, implementing an effective technology platform, creating a scalable pricing structure and developing expertise and relationships now, bankers can gain competitive advantage.

-

Conduct a guided review of your institution's risk tolerance.

-

Develop a risk assessment tailored to the needs of your institution.

-

Define and document the policy considerations of your banking program.

-

Educate your stakeholders, including meetings with regulators.

GET STARTED

SHEDULE A CONSULTATION

Get expert guidance to build your cannabis banking program in Minnesota. Schedule a no-obligation consultation with Shield Compliance today.

The Shield Compliance team can help you unlock the benefits of serving this industry. Contact us to learn how to design a cannabis banking program that meets your financial institution's needs for effective management and operations.

"Partnering with experts who can assist with implementing compliance technologies, risk management policies, and operational processes required for banking this industry will help financial institutions create the foundation for an effective program and ultimately gain the financial rewards of cannabis banking."

Tony Repanich, President & CEO

Shield Compliance

MINNESOTA HEADLINES

Cannabis sector may be a legal headache, but it's a gold mine for deposits

On a blocked-off street in downtown Minneapolis, a crowd of Minnesotans lit up their first legal joints here and puffed... More

BANKING

The cannabis industry still has plenty of legal complications, but for banks seeking deposits, the upside could be worth it.

Minnesota Dispensaries Launch Adult-Use Sales Under State Program

On a blocked-off street in downtown Minneapolis, a crowd of Minnesotans lit up their first legal joints here and puffed... More

LEGISLATION

Vireo Growth launched sales at eight retail locations Sept. 16, while Green Thumb plans to commence adult-use sales at five dispensaries Sept. 17.

Cannabis Licensing Moves Forward Across Minnesota

On a blocked-off street in downtown Minneapolis, a crowd of Minnesotans lit up their first legal joints here and puffed... More

LEGISLATION

The Office of Cannabis Management (OCM) issued its first cannabis business license in June and preliminarily approved more than 1,000 applicants.

WHITE PAPER

Get the Cannabis Banking Playbook

The Cannabis Banking Playbook defines a path forward for financial institutions to serve cannabis-related businesses compliantly while gaining the financial rewards of the legal cannabis market. Sign up to download your copy.

Are You Ready to Serve Minnesota's Legal Cannabis Market?

While banking this line of business offers compelling financial benefits such as new low-cost deposit growth, non-interest income, and the potential for earning assets, banks and credit unions need to make sure they are grounded in the realities of the cannabis industry and the strategic business reasons for getting involved.